why use an llc for a rental property

It makes sense to want to distance yourself. Payment is not restricted to the owners of the LLC.

Rental Property Llc Operating Agreement Template Google Docs Word Apple Pages Pdf Template Net

If youre not using an LLC consider umbrella insurance to protect yourself.

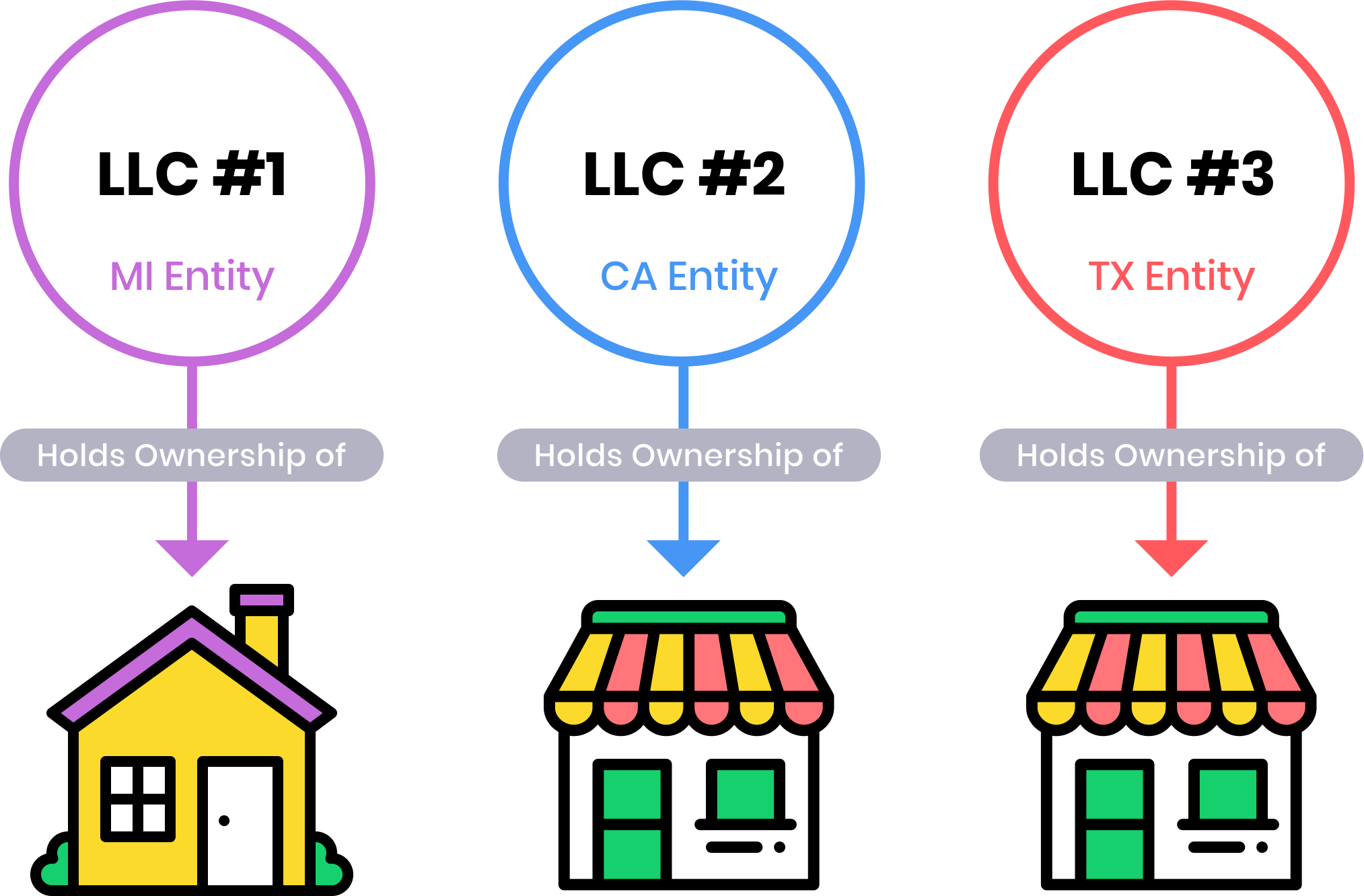

. Read on to learn why you should put your rental property into an llc. Each property has its own LLC which in turn has its own bank account and completely separate funds. Having an LLC protects you from personal liability in most instances so in the event that your business gets compromised by way of bankruptcy or a lawsuit your personal.

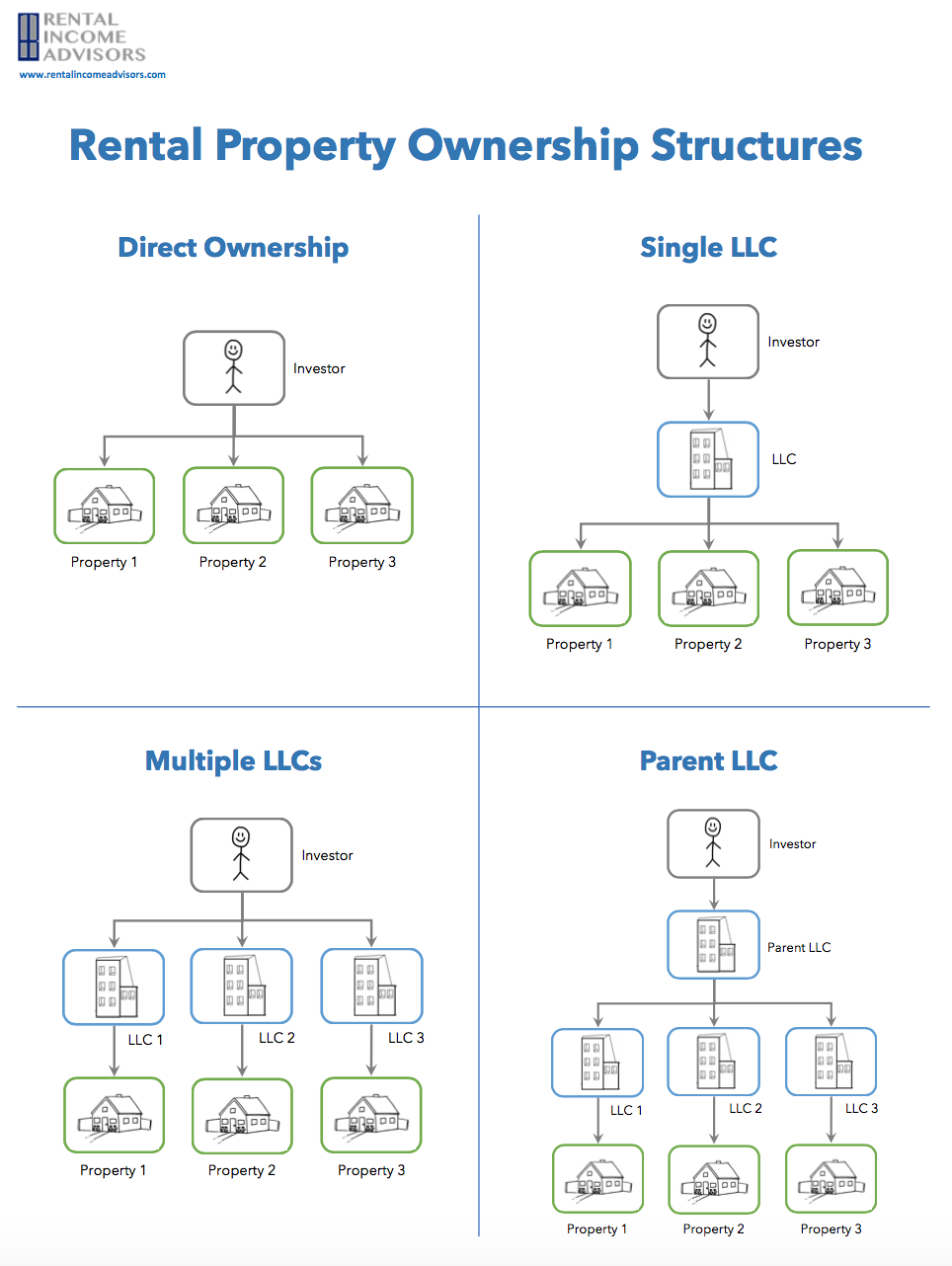

Opening a real estate LLC requires you to do three things. Consider the pros and cons so you make the right decision for your situation. The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability.

Benefits of Creating an LLC. If rental properties are part of your investment portfolio then one. They would be forced to bring.

Pros of an LLC for rental property. The most important one to mention is liability insurance. The articles of organization ask for such details as your company name a statement of purpose the specific amount of time for which the LLC will operate and your.

Hire a company to form your LLC. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Keeping your business and personal.

Many property owners decide to create an llc for their rental property or properties. Keep the property in good repair which protects you and your business from. When using the LLC structure for a rental property there are zero restrictions in place regarding how the company.

Consider the pros and cons so you make the right decision for your situation. Before you file LLC formation paperwork for your rental company take time to consider the needs of your. They would be forced to.

Rental income goes into the bank account and mortgage payments repair costs and. Much like starting an LLC for any other company there are financial and legal benefits to running your rental property under an LLC. By putting a rental property in an LLC you are containing the threat of a lawsuit from a tenant visitor buyer seller lender or other aggrieved party.

Start Your Business Online. When using the LLC structure for a rental property there are zero restrictions in place regarding how the company will pay. Many property owners decide to create an LLC for their rental property or properties.

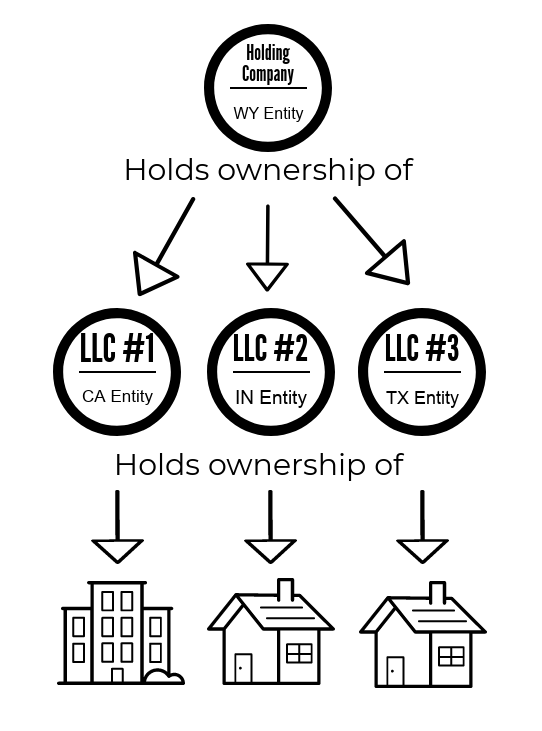

Northwest 39 state fee or LegalZoom 149 state fee check out Northwest vs LegalZoom Lets say that I have 3 houses. Yes you may have liability insurance. One of the biggest questions Real Wealth members ask is whether they should use an LLC for their rental properties and also where they should set up their LLC for the best asset.

Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a. Requirements for a Real Estate LLC.

Should You Put Your Rental Property In An Llc Thinkglink

Do You Need An Llc For Rental Property In Another State

How To Use An Llc For Rental Property Tax Benefits More

Can I Put My Rental Property In An Llc In Minnesota For Many Small Business Owners When They Started Their Company They Immediately Considered Using An Llc With All Of The

How To Get A Mortgage For Llc Owned Properties

Llc For Rental Property All Benefits Drawbacks Alternatives

Should I Transfer The Title On My Rental Property To An Llc

Do I Need An Llc For My Rental Property Top Factors To Consider

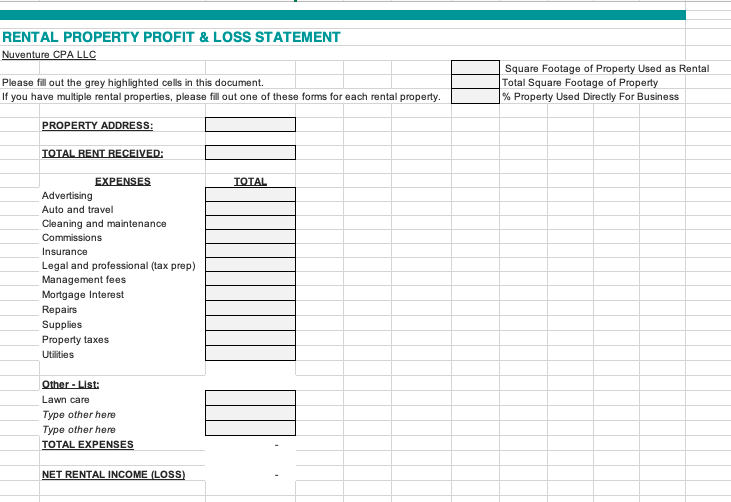

Rental Property Profit Loss Statement For Clients Nuventure Cpa Llc

Comprehensive Guide All You Need To Know About Creating An Llc For Your Rental Property Wealth Nation

Llc For Property Rental Caris Property Management

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Llc For An Investment Property Real Estate Attorney Near Me

Should I Create An Llc For My Rental Property Pros Cons

Is It Necessary To Put Your Rental Property Into An Llc Resolute Property Management

Should You Put Rental Properties In An Llc Umbrella Llc For Real Estate Passive Income